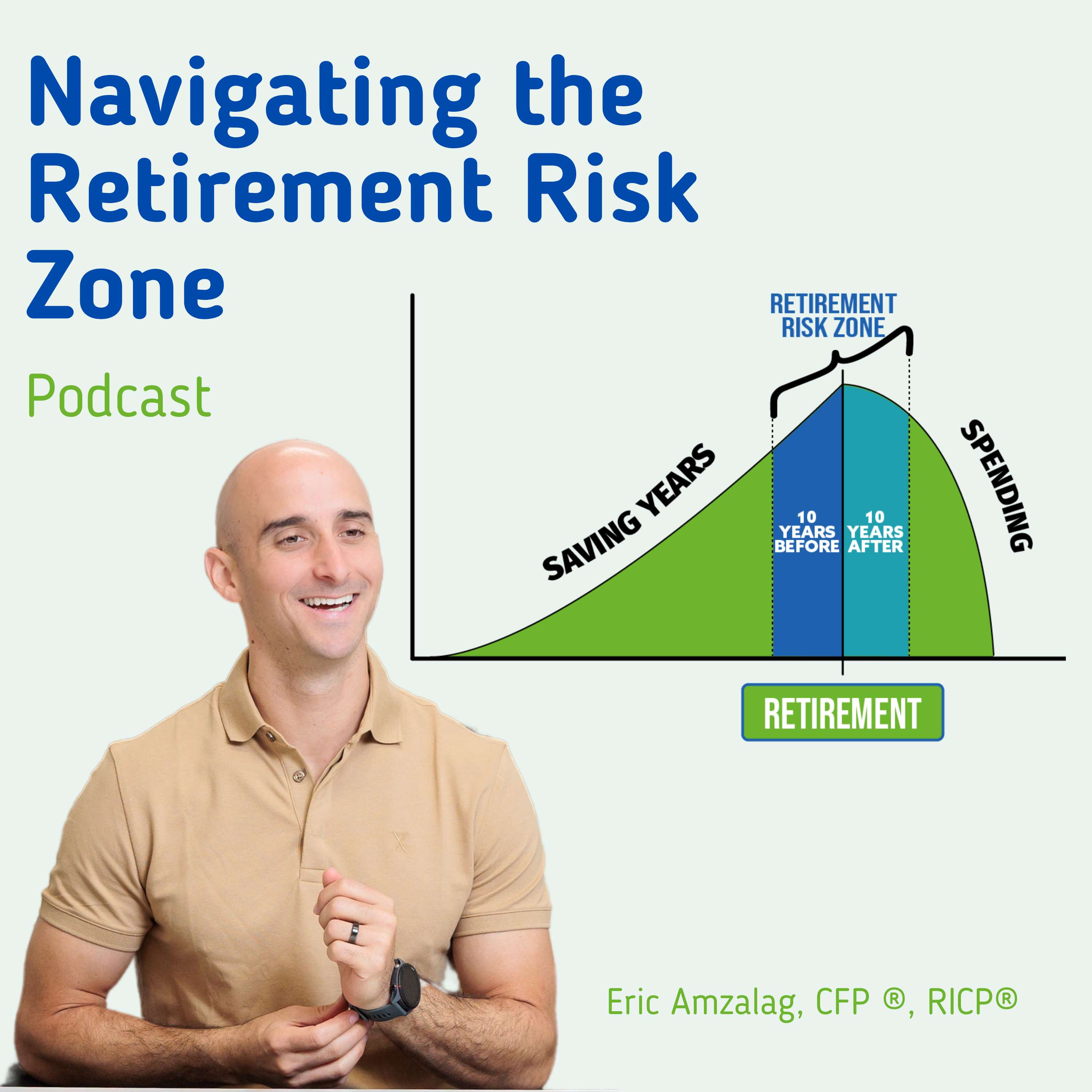

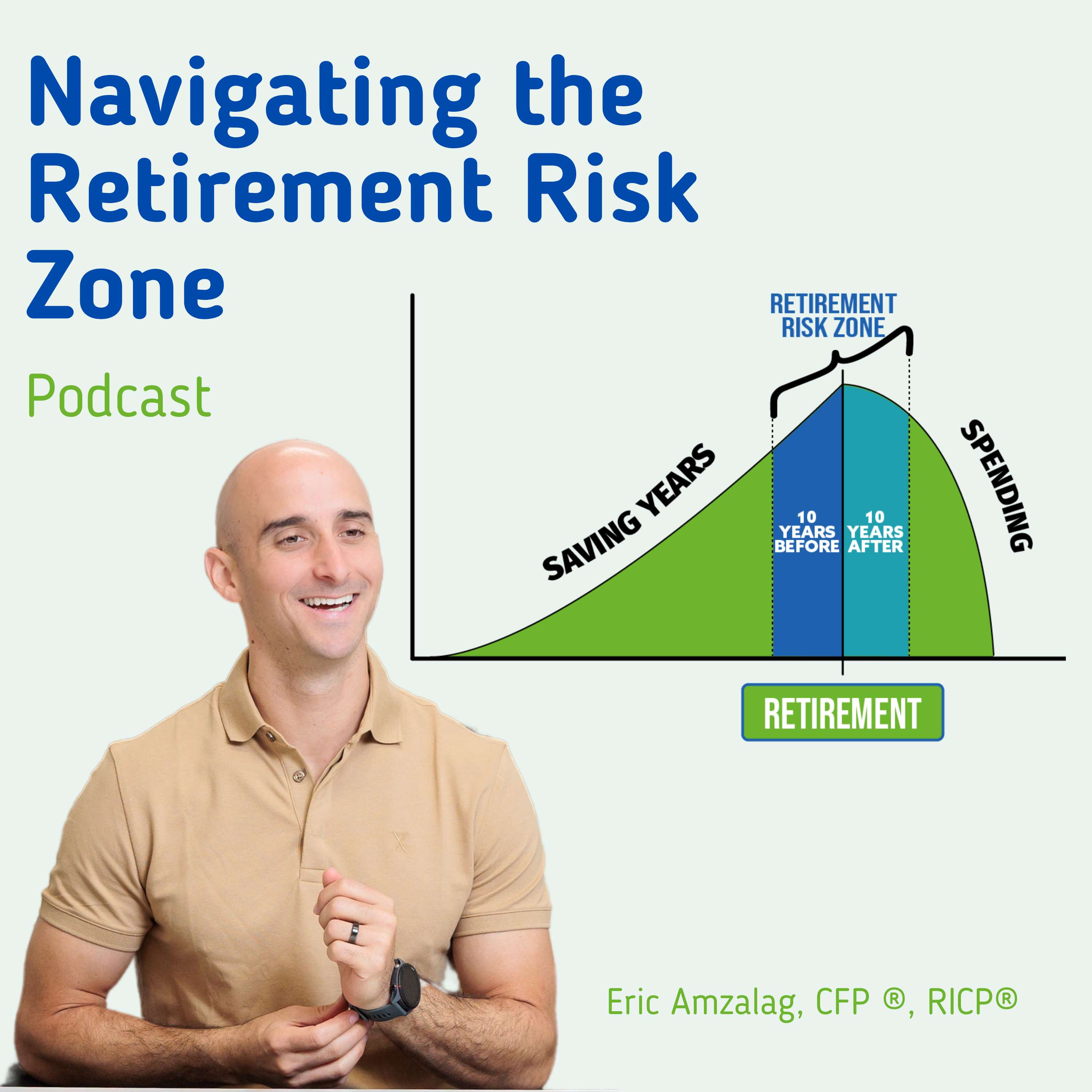

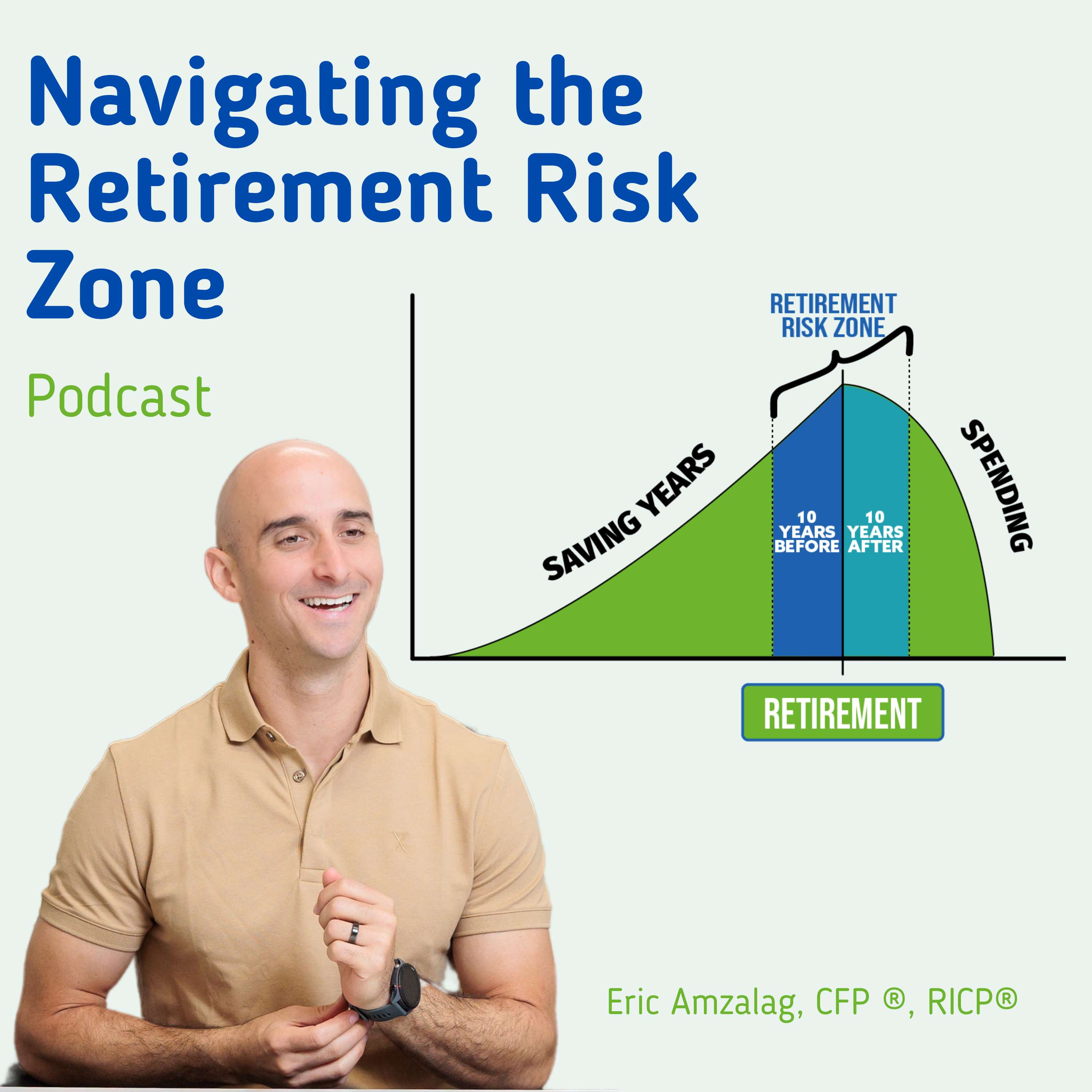

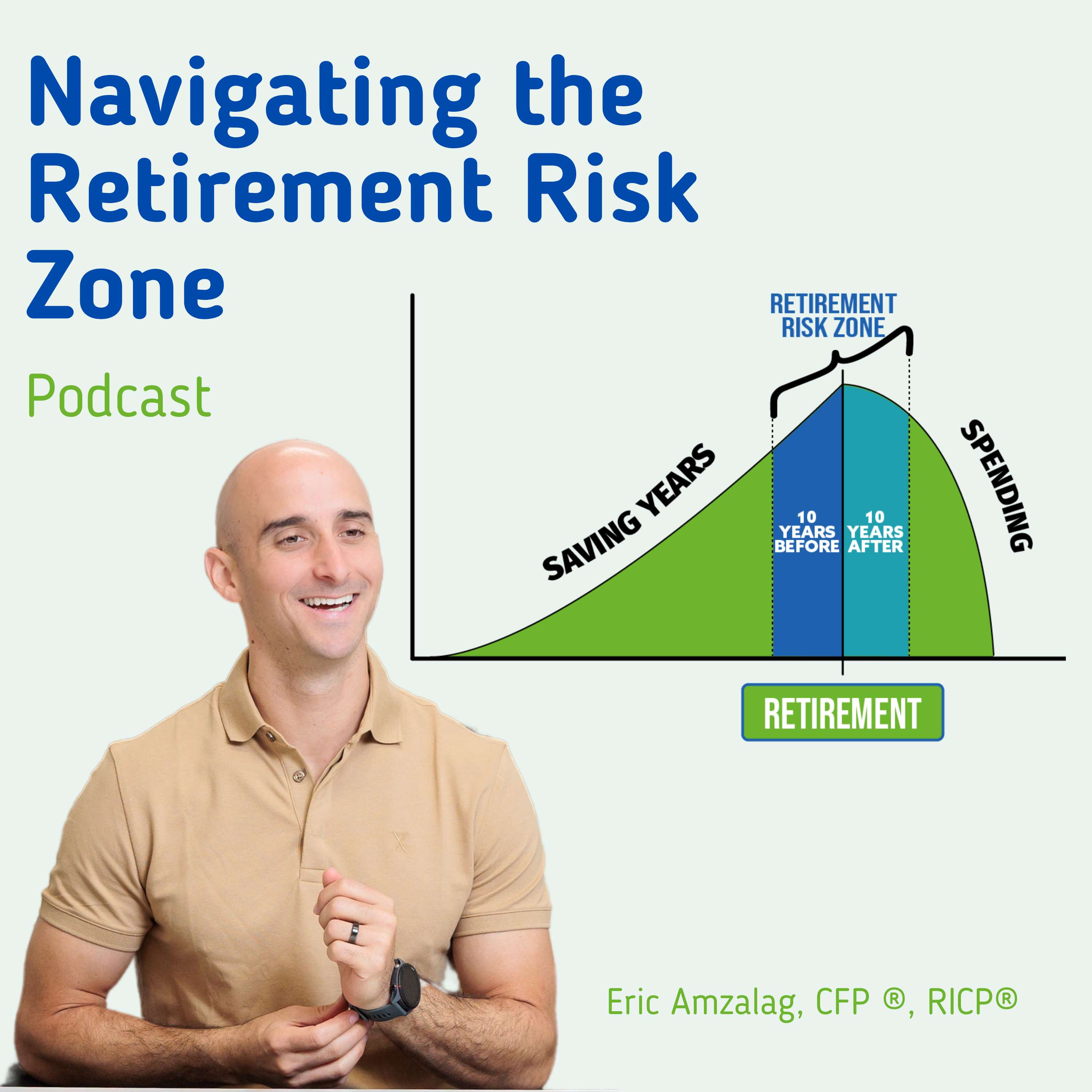

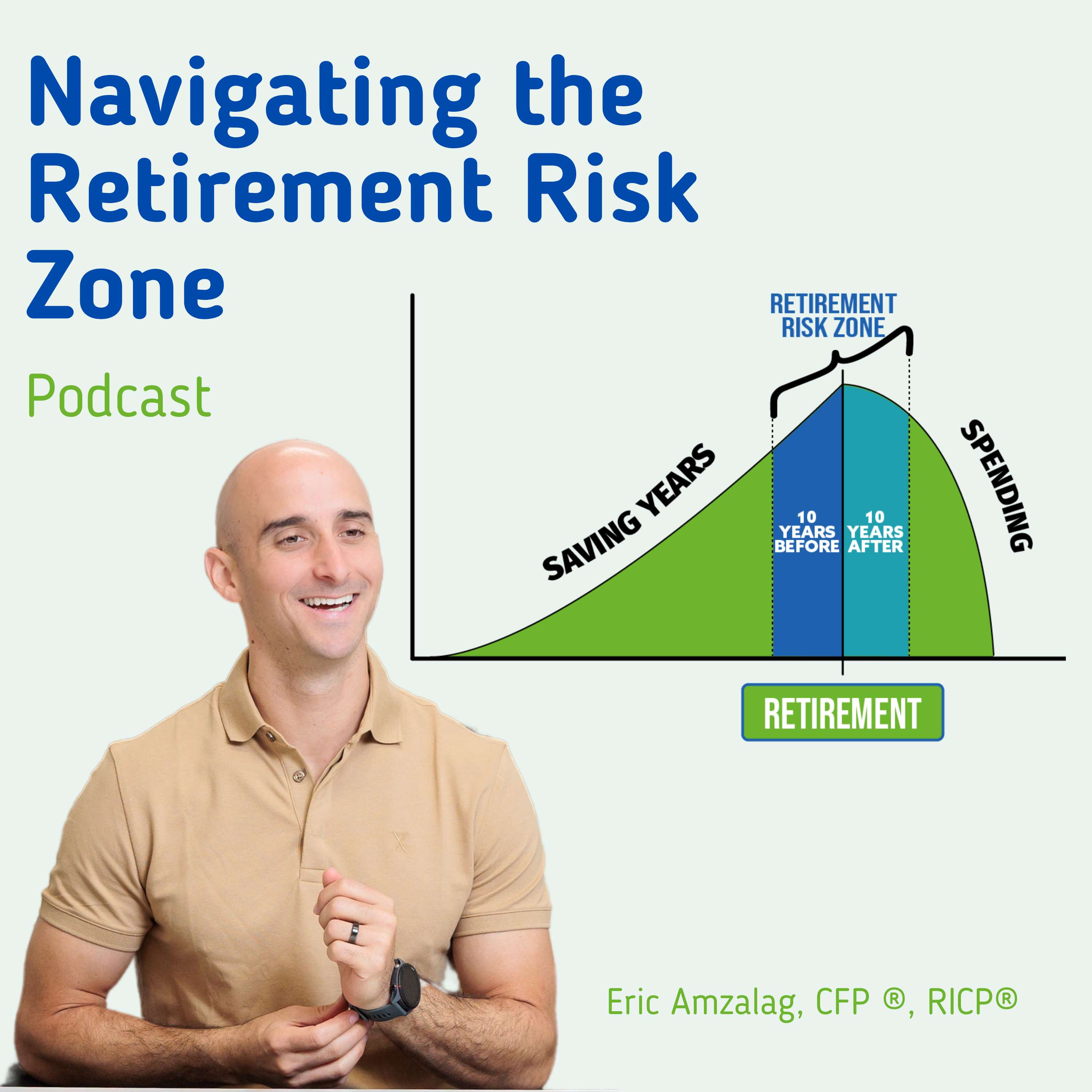

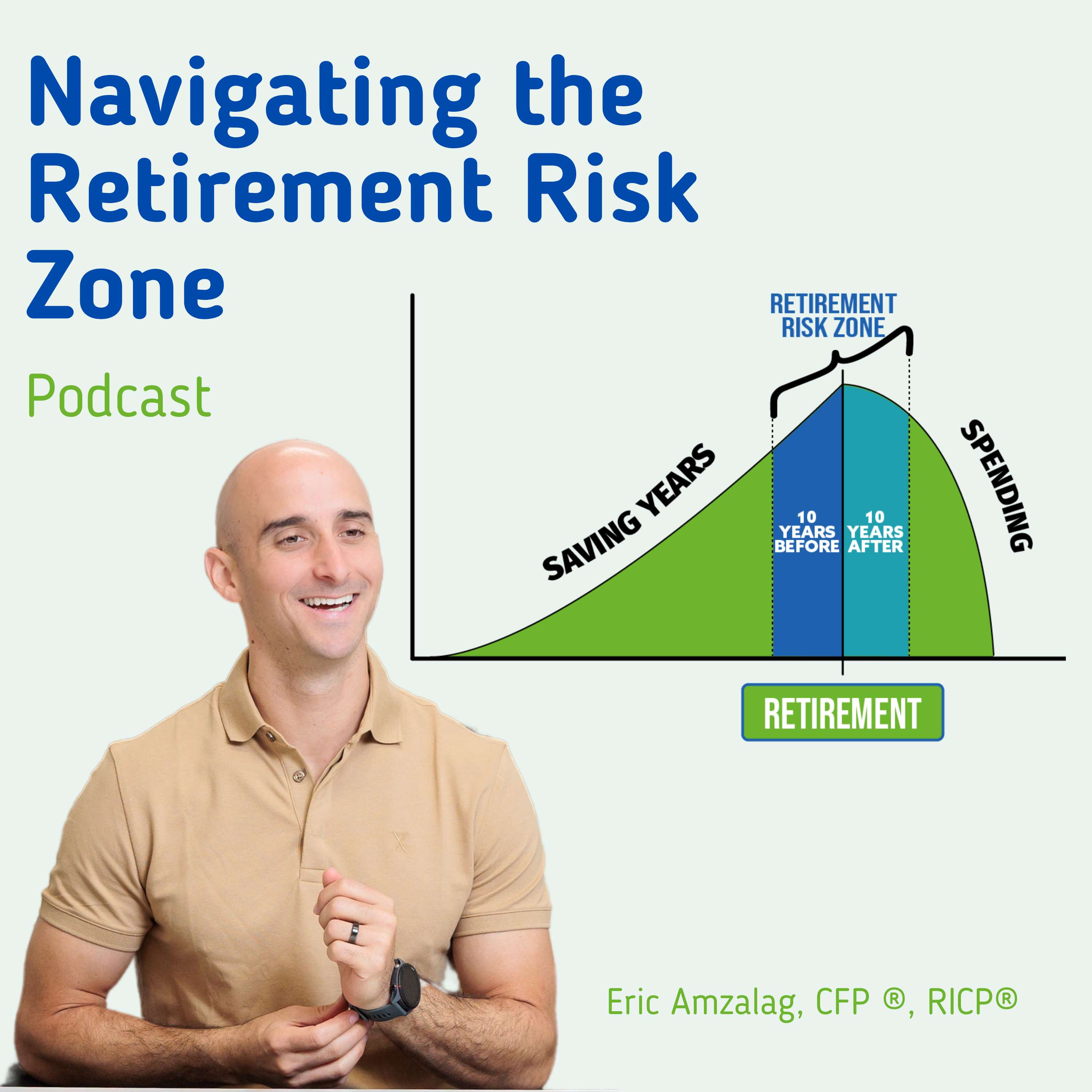

The Retirement Risk Zone is the period of time that begins roughly 10 years before retirement and ends 10 years into retirement. During that time, you will make many of the most consequential financial decisions of your life, including your exact retirement date and age, when to claim social security, how to claim Medicare, how to reposition your retirement assets, as well as how to create an income from retirement savings. So much focus is put on the accumulation (Savings phase) of retirement, or the distribution (spending phase) of retirement that the risk zone often gets overlooked despite its importance. This podcast is designed to not only help you navigate the retirement risk zone but thrive in retirement. My name is Eric Amzalag, I am a Certified Financial Planner TM, Retirement Income Certified Professional, and owner of the independent Financial Planning and Wealth Management Firm Peak Financial Planning. Let's explore retirement income planning, social security, retirement investing, and retirement satisfaction together. Happy Retirement Planning!

Charts

- 36Increased by 101

Episodi recenti

Dec 4, 2024

How to evaluate a retirement investment portfolio

E14 • 13 mins

Nov 20, 2024

Is The 1% Rule Actually Worthwhile in Retirement?

E13 • 8 mins

Oct 30, 2024

50% Outrun Savings in Retirement? Here's Why They're Wrong...

E12 • 5 mins

Oct 16, 2024

The #1 Sign You Can Retire Earlier Than You Think

E11 • 7 mins

Sep 25, 2024

Stop Paying RMD Taxes: How To Avoid Costly RMD Mistakes

E10 • 12 mins

'/%3e%3cpath%20d='M74.965,77.269%20C74.795,75.733%2074.283,74.624%2073.259,73.6%20C71.339,71.595%2067.968,70.272%2064,70.272%20C60.032,70.272%2056.661,71.552%2054.741,73.6%20C53.76,74.667%2053.205,75.733%2053.035,77.269%20C52.693,80.256%2052.907,82.816%2053.248,86.955%20C53.589,90.88%2054.229,96.128%2055.04,101.419%20C55.637,105.216%2056.107,107.264%2056.533,108.715%20C57.259,111.104%2059.861,113.152%2064,113.152%20C68.139,113.152%2070.784,111.061%2071.467,108.715%20C71.893,107.264%2072.363,105.216%2072.96,101.419%20C73.771,96.085%2074.411,90.88%2074.752,86.955%20C75.136,82.816%2075.307,80.256%2074.965,77.269%20z'%20fill='%23FFFFFF'%20id='XMLID_657_'/%3e%3cpath%20d='M74.496,55.509%20C74.496,61.312%2069.803,66.005%2064,66.005%20C58.197,66.005%2053.504,61.312%2053.504,55.509%20C53.504,49.707%2058.197,45.013%2064,45.013%20C69.803,45.013%2074.496,49.749%2074.496,55.509%20z'%20fill='%23FFFFFF'%20id='XMLID_655_'/%3e%3cpath%20d='M63.872,14.165%20C39.381,14.251%2019.328,34.133%2018.987,58.624%20C18.731,78.464%2031.403,95.445%2049.109,101.675%20C49.536,101.845%2049.963,101.461%2049.92,101.035%20C49.707,99.499%2049.451,97.963%2049.28,96.427%20C49.195,95.872%2048.853,95.445%2048.384,95.189%20C34.389,89.088%2024.619,75.051%2024.789,58.795%20C25.003,37.461%2042.411,20.096%2063.701,19.925%20C85.504,19.755%20103.296,37.419%20103.296,59.179%20C103.296,75.264%2093.568,89.088%2079.701,95.189%20C79.189,95.403%2078.848,95.872%2078.805,96.427%20C78.592,97.963%2078.379,99.499%2078.165,101.035%20C78.08,101.504%2078.549,101.845%2078.976,101.675%20C96.512,95.531%20109.099,78.805%20109.099,59.179%20C109.013,34.347%2088.747,14.123%2063.872,14.165%20z'%20fill='%23FFFFFF'%20id='XMLID_653_'/%3e%3cpath%20d='M62.848,29.099%20C46.891,29.696%2034.091,42.88%2033.877,58.837%20C33.749,69.333%2038.997,78.635%2047.061,84.139%20C47.445,84.395%2048,84.096%2048,83.627%20C47.872,81.792%2047.872,80.171%2047.957,78.464%20C48,77.909%2047.787,77.397%2047.36,77.013%20C42.453,72.405%2039.467,65.835%2039.637,58.581%20C39.979,45.781%2050.261,35.371%2063.061,34.859%20C76.971,34.304%2088.405,45.483%2088.405,59.221%20C88.405,66.219%2085.419,72.533%2080.683,77.013%20C80.299,77.397%2080.085,77.909%2080.085,78.464%20C80.171,80.128%2080.128,81.749%2080.043,83.584%20C80,84.053%2080.555,84.395%2080.981,84.096%20C88.917,78.677%2094.165,69.504%2094.165,59.179%20C94.208,42.197%2080,28.416%2062.848,29.099%20z'%20fill='%23FFFFFF'%20id='XMLID_651_'/%3e%3c/g%3e%3c/svg%3e)